Do you love the exciting and fast paced atmosphere of real estate? Bascomb Real Estate Group is hiring a Real Estate Broker, a real estate professional, to join our team and add value to our and your business. You will be tasked with educating our clients on the homebuying process; growing our customer base by generating leads; counseling clients on market conditions; home buying strategies; and contributing to the continued growth of the firm. You will also be in charge of creating lists of real estate properties and presenting purchase offers to sellers. This is a great opportunity for someone looking to grow their career in real estate with a brokerage that is focused on the value and commitment we offer our clients.

Real Estate Professional Responsibilities:

- Provide guidance and assist sellers and buyers in marketing and purchasing property for the right price under the best terms.

- Generate client leads to buy and sell the property.

- Determine clients’ needs and financial abilities to propose solutions that suit them.

- Intermediate negotiation processes, consult clients on market conditions, prices, mortgages, legal requirements, and related matters, ensuring fair and honest dealing between buyers and sellers.

- Perform comparative market analysis to estimate properties’ value for sellers.

- Serve as a buyer’s agent providing the required support needed to ensure the client finds the home they seek.

- Prepare necessary paperwork (contracts, leases, deeds, closing statements etc.….) as needed.

- Create lists for real estate sales, with information on location, features, square footage, etc.…..

- Cooperate with appraisers, escrow companies, lenders, and home inspectors.

- Develop networks and build a list of resources to include: attorneys, mortgage lenders, contractors, inspectors, and partner brokers.

- Promote sales through advertisements, marketing, open houses, and listing services.

- Remain knowledgeable about real estate markets and best practices.

- Ensure continuing education is always current including state and local licensing if applicable.

Real Estate Broker Requirements

- Must be a licensed real estate broker.

- Strong customer service skills.

- Must be in good standing with the local Realtor board, or an inactive broker who can immediately move his/her license.

- Experience with sales.

- Strong interpersonal skills.

- Good knowledge of the local markets and properties.

- Possess a valid driver’s license.

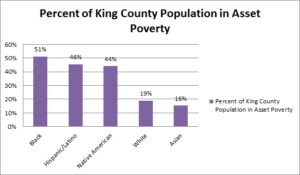

- Must be willing to work with first-time homebuyers and low to moderate-income communities in addition to ‘traditional’ homebuyers.

- Must adhere to the mission and values of the brokerage.

- Must have possessed your broker license for at least one year.

- Able to work independently and in a professional manner.

Real Estate Broker Desired Skills and Qualifications:

- Prospecting Skills

- Problem Solving

- Territory Management

- Legal Compliance

- Negotiation skills

- Lending background a plus

- Spanish speaking is a plus

Bascomb Real Estate Group is a certified black/woman-owned business committed to our communities and the positive growth of its citizens. Our brokerage is dedicated to providing a positive and productive place to work and grow for our brokers and staff while serving the mission of the company. As a growing firm, we are looking for dynamic brokers wanting to be a part of an amazing team making lasting impacts in the community.

This real estate professional position offers a very competitive commission split; access to an expanding network; flexibility around scheduling including working part-time; working virtually with no desk fees; continuing education opportunities; and the opportunity to join a dynamic, growing brokerage.